STOCK MARKET CRASHES!

How to Make Money in Uncertainty

Welcome to Polymathic Being, a place to explore counterintuitive insights across multiple domains. These essays explore common topics from different perspectives and disciplines to uncover unique insights and solutions.

STOCK MARKET CRASHES!

If that phrase raised your blood pressure and caused a quiver of panic, you’re not alone. Today's topic explores the psychology of the stock market, revealing why the most painful days often occur when nobody expected them.

Intro

Many of us have our hopes pinned on a future where the market continues to rise, at least outpacing inflation to grow our net worth and allow us to comfortably retire. Over the past few months, the volatility of politics, world events, and more has the news media clutching their pearls about a potential stock market crash. Yet, there’s a super counterintuitive insight from these dire predictions: The market never crashes when you expect it to.

Pause for a second and consider the logic behind that, as well as the history of crashes. The market reacts to unknown surprises, what Nassim Taleb calls Black Swan events, not known volatility. In fact, the more you expect the market to crash, and the more EVERYONE expects the market to crash, the less likely it will happen. That’s because of three market theories:

The Efficient Market Hypothesis posits that all known information is already reflected in stock prices. If everyone expects a crash, that sentiment is likely priced in already through selling or hedging. Thus, paradoxically, the market may stabilize or rise when fear peaks — because there's no one left to sell.

Reflexivity, coined by George Soros, shows that market prices don’t just reflect reality; they also shape it. If everyone expects a crash and acts accordingly (selling, buying puts, hoarding cash), they might prevent the crash by preemptively deflating the bubble. Conversely, when no one is worried and leverage builds, a small shock can cause a much larger unraveling.

Contrarian Investing underpins the strategies of many successful investors (e.g., Warren Buffett’s "Be fearful when others are greedy, and greedy when others are fearful.") Market tops are often characterized by euphoria and complacency, while bottoms occur during despair and panic.

"Be fearful when others are greedy, and greedy when others are fearful."

COVID was an example where the shock of rapid lockdowns rippled through the economy, and dire predictions flowed through the media. While there was an initial sharp dip, it rapidly rebounded to even higher levels as the predictions didn’t materialize. This is because we saw the virus coming for a month, first in rumors, then in an inflation of panic, but we saw it coming.

Compare this to the 2008 crash, which was triggered by the housing market shenanigans. A few people were warning about the risks large financial firms were taking in the mortgage industry, involving complicated derivative mechanisms and a lot of greed. However, when the house of cards crumbled, very few saw it coming. The shock of the correction, coupled with the exposure of the fraud, collapsed investor confidence and sent the market and the rest of the economy into a spiral. (For a deep, insightful analysis of 2008, I highly recommend “The meltdown and the bailout: why, how, and what they mean” by John Silveira)

During COVID, we expected problems; during the 2008 crash, we ignored the problems. So, where does that put us today, when we still have a lot of pundits claiming the Trump administration's tariffs are going to gut the economy?

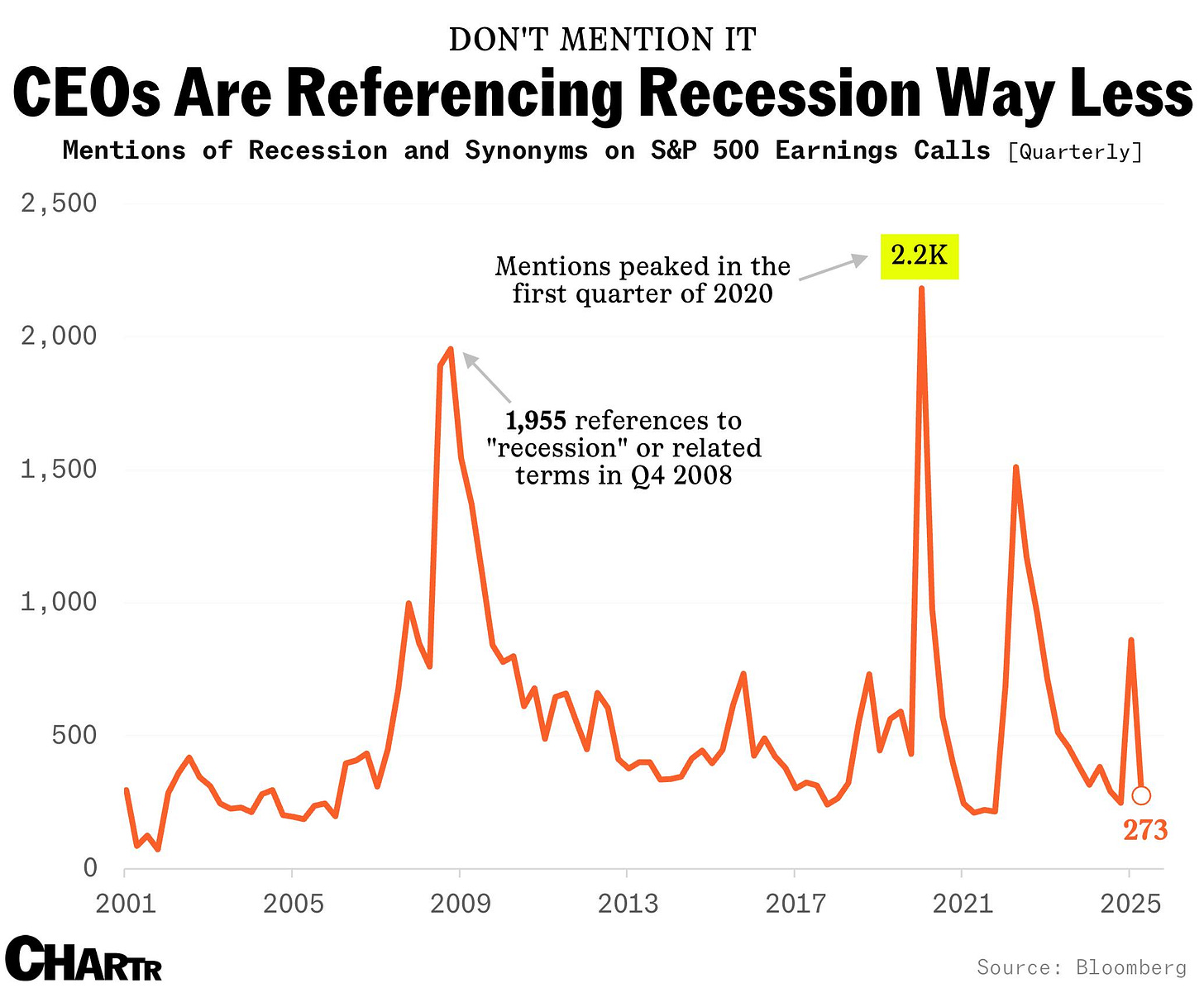

Well, that threat emerged on the campaign trail in 2024. Then, in January 2025, Trump announced the tariffs that would go into effect months in the future. Over that time, they’ve been on again, off again, but typically negotiated lower. Because they’ve been a slowly growing wave for months, they’re not unknowns and have been priced into the market. In fact, Sherwood News recently reported that “Investors and CEOs have completely ditched the idea that tariffs will cause a recession.”

Ironically, that actually increases the risk as we may be underestimating the impact; however, we know these tariffs are being applied, and so these CEOs, in concert with their CFOs, are pricing that risk into their earnings calls. We’ve seen that in the revised estimates in many Q2 reports. The market is already pricing in the risk.1

When people are pessimistic, before an actual event, the risk of a stock market crash lowers dramatically as people take proactive action. In fact, it’s a great time to analyze and buy. Conversely, when people are overly optimistic and the talking heads are only discussing the upside, I recommend diversifying into more pragmatic investments.

Practical Steps

Let’s shift gears and consider a few tips and resources available to help you make better sense of the market:

It’s not about timing the market; it’s about time in the market. This is an oldie but goodie, as it’s true. Day trading, speculating, and shifting assets in large lumps all at once is volatile and risky. Slow and steady wins the race.

Follow an antifragile barbell approach recommended by Nassim Taleb. Simply put, balance high risk against low risk so when problems happen, you’re diversified.

Sound Mind Investing has a great starter guide to investing, along with recommendations for investment strategies. Their returns are solid for those who want to manage their own portfolio, and I learned a lot using them.

Recognize that all those people lauding massive gains and big wins also never share their losses. It might look like they’re pulling in millions a week, but those are offset by $999,999 losses as well.

An investor friend admitted to me that he quit because he was working 80 hrs a week to scrape only 1-2% better than the market. His recommendation was index-based ETFs as a core with a balanced high and low risk barbell.

Exchange-traded funds, known as ETFs, are your friend. They’re low-cost, often market-indexed, and allow you to grow with the market instead of putting in tons of effort for little gain.

Invest in dividend funds. Folks like Steve Kang and TheGamingDividendinvestigate and recommend diversification through dividends.

Of note, I’m invested in the YieldMax series of funds, which, while high risk, are also high reward and can provide pretty solid monthly income streams. You can check out a deeper analysis and risk profile here.

A critique of the dividend advisors is that they only talk about dividend income, not total investment and investment return. Getting $5K a month in dividends on $200K of investments isn’t great. Also, how’s the stock/ETF you’re invested in doing regarding that initial investment? Bear that in mind.

Invest early, invest often. Building from #1, don’t wait to invest. Always set aside money, even when it’s not much, because the compounding growth and risk distribution are critical.

Get-rich schemes are schemes. They rarely work, and they’re a lot of stress. Slow and steady, diversified, risk-balanced, and non-reactive end up winning over time.

Be fearful when others are greedy, and greedy when others are fearful.

Now, I’m going to have to put in the standard disclaimer that you do you with your money, and I’m not a financial advisor. We’re just here today to understand market psychology, risk management, and general themes. While we see a lot of worry about the market and I’m, therefore, more aggressive in my investments, I’m also starting to see too much zeal in other areas like cryptocurrency, and the emergence of a lot of highly speculative and algorithmically derived trading vehicles (Yield Max, I’ve got my eye on you.)

Hopefully, you’ll walk away with a slightly better understanding of how to read the pundits, how to sort through the advisors, and have an introduction to balancing your portfolio in a more antifragile manner.

What are your best insights on investing in the market? What were things you wished you’d known when you were younger, or actions you wished you’d taken over time? Join the conversation in the comments.

Did you enjoy this post? If so, please hit the ❤️ button above or below. This will help more people discover Substacks like this one, which is great. Also, please share here or in your network to help us grow.

Polymathic Being is a reader-supported publication. Becoming a paid member keeps these essays open for everyone. Hurry and grab 20% off an annual subscription. That’s $24 a year or $2 a month. It’s just 50¢ an essay and makes a big difference.

Further Reading from Authors I Appreciate

I highly recommend the following Substacks for their great content and complementary explorations of topics that Polymathic Being shares.

Goatfury Writes All-around great daily essays

Never Stop Learning Insightful Life Tips and Tricks

Cyborgs Writing Highly useful insights into using AI for writing

Educating AI Integrating AI into education

Socratic State of Mind Powerful insights into the philosophy of agency

For a deeper analysis of the current market, risks, and reality, check out this article:

I love the crashes. I mean, I don't love how horrible it is for folks to live through, but they are endlessly fascinating. I remember that 1987 crash where we were studying stocks in social studies class, but I didn't really get what was going on until much later. 2008, I was way more focused on growing small businesses and not the market, but I studied up during the 2010s and really dove in. I love studying those cycles.

I wonder what you’d struggle to do a deep dive on. Loved this one brother. Saved for reference after tax return season. I’m diversified and well-invested but you’ve still given me a few more ideas per usual. Thank you